Digital business models, new challenges: A development that particularly affects the IT organization of companies. Until recently, IT was an on-demand service provider, but in future it will play an active role in shaping business. The age of the IT manufacturer is coming to an end – the age of the IT service provider with commercial responsibility is beginning. In future, it will be part of every CIO’s toolkit – they must now be able to manage IT in an entrepreneurial way. The four pillars of ITFM form the foundation for this.

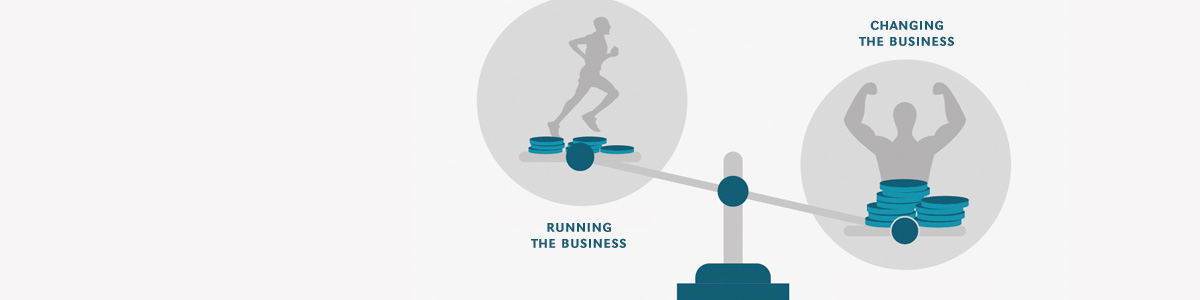

The balance between ongoing operations and transformation

Ideal ITFM captures OPEX and CAPEX information in full and presents it in an understandable view. This makes it clear how high the investments in the IT organization currently are and whether these investments were made for business operations (running the business) or for changes in the business – such as digitalization projects or innovations (changing the business).

IT managers directly see the investment ratio for:

- maintaining the business

- the growth of the business

- the transformation of the business

From this perspective, there are two necessary planning areas for the strategy:

- The amount of current investment required over the planning period to ensure business continuity. This includes investments for the replacement and maintenance of business services with the underlying hardware and software assets, licenses, as well as personnel and other general costs.

- The amount of future investment funds for the expansion of the environment, technological transformation or the introduction of new business services. The distinction between ongoing obligations and CAPEX investments is particularly important for financing.

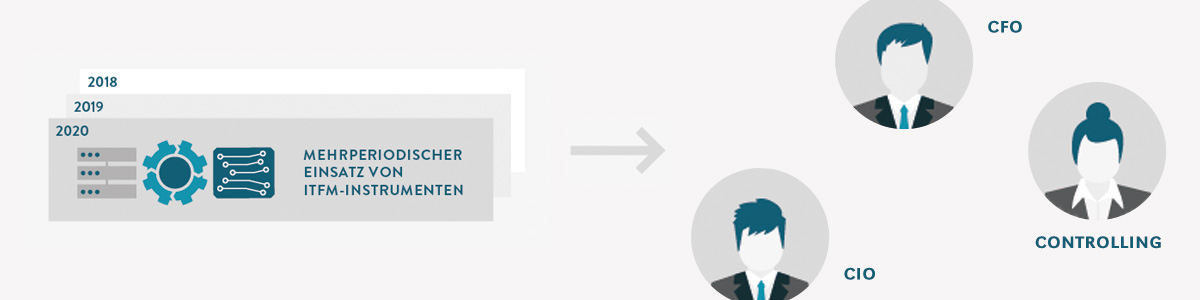

Transparency creates acceptance

At the heart of investment and strategic planning is the challenge of providing the right amount of funding, in the right form and at the right time. The IT financial model is developed on this basis. The results must be transparent, clear and comprehensible for the decision-makers in management, the board and the finance department. The holistic and at the same time differentiated planning presented prevents typical omissions over time. These include, in particular, the incorrect provision of budgets due to situational necessity and the risk of running out of the budget plan at the end of the planning period.

Through the consistent use of ITFM tools, planning becomes more accurate and more comprehensible for the entire IT organization. As a result, they meet with greater acceptance from top management. Furthermore, changes over time (dynamic investment planning) can be derived and used for budget argumentation. This makes shifts in investments and the need for new funds clear.

Top management sees: The IT organization uses the funds responsibly for the company’s goals.

Typical results are a systematic shift of investment from running-the-business to changing-the-business. This enables IT management to make its contribution – also with regard to longer-term missions in the company such as performance campaigns, digitization strategies or cost-saving programs.

Optimal ITFM enables CIOs to meet management at eye level. They are able to gain an overview of IT expenditure. They speak the language of finance and can clearly allocate investments to the needs and interests of the respective target group. This means that the value of the respective investments for the company can be demonstrably justified.

As a result, the strategic nature of the IT organization is once again significantly emphasized.

Asset Management

Asset management combines technical and commercial IT considerations and is therefore the basis for accurate IT financial management.

Sophisticated ITFM tools enable the recording and mapping of all IT assets. They do not necessarily replace the existing Configuration Management Databases (CMDB) or replace them as the leading systems, but rather make use of their content. The interest of ITFM is the focus on capital requirements planning, as well as on CAPEX and OPEX considerations – outside of existing Enterprise Resource Planning (ERP) systems such as SAP.

Financial management in IT focuses on budget planning and budget monitoring from within IT. ITFM enables commercial information from new assets to be recorded during the year, expiring assets to be removed from the budget planning at the right time and information to be provided on when changes will affect the budgets.

The changes and influences must be differentiated in ITFM with regard to CAPEX and OPEX-relevant content, although a holistic view must be maintained.

Monitoring budgets with complex, outdated Excel spreadsheets or obtaining figures from the ERP system via third parties is fraught with danger. It restricts CIOs from making business-relevant decisions or being able to report to the CFO at any time.

A minimum requirement is the analysis and comparison of expenditure of the various asset classes in relation to total expenditure.

Asset management in the context of ITFM is therefore part of financial reporting and controlling of IT in the narrower sense. Despite its essential function, it is not part of strategic management but of operational management and therefore forms the basis for the other elements of ITFM. Asset, capital requirements, CAPEX and OPEX management are therefore also the subject of mid-level IT management. Modern ITFM tools should also address this target group and provide the corresponding views.

Benchmarking as an optimization approach

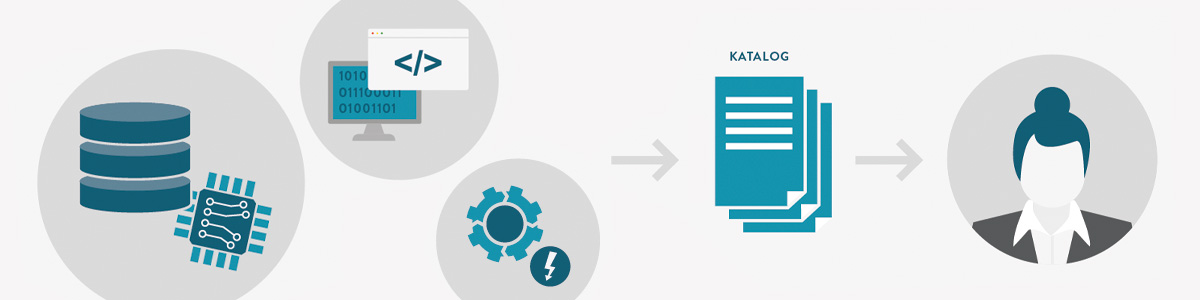

IT Financial Management also includes benchmarking as a basis for cost optimization. A service overview is mapped for cost optimization. This includes the business services in the services catalog as well as the sub-services accumulated in each, such as infrastructure services or licenses.

These two classifications make IT expenditure comparable and easier to understand for service recipients. The aim is to translate the management of IT expenditure into a language that all parties involved understand:

- the technology providers for price negotiations

- the technology buyers in the company

- the company’s own responsible employees

This increases transparency and therefore the ability to analyze, optimize and compare costs and services. For IT controlling, the focus is on minimizing unit costs and the total cost of ownership (TCO) for each technology domain. By organizing IT expenditure in this way – as specified by IT – the CIO and his management have the reins of the cost structure and the optimization perspective in their own hands.

If the company pursues goals such as optimization efforts and uses benchmarking as part of IT financial management, the best-practice approach described above can be used. This allows costs and additional key personnel figures to be compared with the values collected by central bodies, such as Gartner. Typical indicators for this are IT expenditure as a percentage of sales, operations, IT expenditure as part of “Run, Grow, Transform” or OPEX by technology domain.

Benchmarking with comparable or, at first glance, non-comparable companies makes it possible to locate one’s own performance and cost performance and reveals possible optimization potential at a high level.

Decision-making aids for the CIO

For the CIO’s decisions, it is essential to identify the cost drivers of IT at a technological level in order to incorporate the diverse requirements of digitalization into a performance and cost-oriented plan, to make technology decisions on a commercially comparative basis and to incorporate make-or-buy decisions. The total cost of ownership for the technology areas is clarified and can be separated according to consumed and purchased services or consumed provisioned services. Deviations and shortfalls offer scope for optimization.

Transparency in the service catalog

The IT service catalog and the underlying service costs and prices are key performance indicators for the business. Here, too, it is essential to be able to provide the business with information about the costs incurred. Modern IT financial management solutions offer the business a self-service that prepares the necessary database in such a way that it can also be interpreted by non-IT managers. ITFM thus takes on a central controlling task and automates evaluations to support decision-making.

Business management should be interested in which services are purchased and what expenses or costs are incurred as a result. The relationship between price and performance can only be assessed if it is presented transparently. A more precise definition of services is often required. What are the key features of an IT business service, which service level agreements are included and how scalable is the solution in terms of business development? IT and business must go hand in hand here in order to master upcoming challenges in ever faster changing business environments. A cryptic description of services that are not understood by users, stakeholders and commissioners is no basis for IT management.

The service catalog must be clear, understandable and tailored to the target group. This explicitly means that the number of business services offered and thus the items in the service catalog must also be limited.

This is where specific, heterogeneous requirements from the business meet an ideally cost-optimized technology base that is as homogeneous as possible.

ITFM tools can resolve this conflict by breaking down the higher-level IT service catalog items into underlying infrastructure services, hardware, software and licenses for the interested business manager. This in-depth drill-down creates considerable potential for designing and sizing the right business services in terms of type and scope.

Identification of cost drivers and potentials

As soon as stakeholders understand the business and know which parts of a service are cost drivers, intrinsic optimization processes take effect. IT management can work together with the business to optimize services from both a cost and performance perspective without relinquishing control over strategic technology decisions.

The aim of this process should be a service portfolio that shows both the services currently offered and the performance potential they contain. This distinction is of central importance from a cost perspective. Not all of an IT organization’s costs go directly into the services provided, but into the procurement, administration and maintenance of core business applications or are simply not attributable. At the same time, capacity potential remains that is kept available but not used by the business. A service portfolio maps these aspects and also contributes to IT risk management, which in turn is in the interests of the business.

In many companies, however, there is no active chargeback of IT services within the company and an upstream showback is still not standard practice. Cost accounting systems, internal cost allocation and controlling resources are often unable to guarantee this. It is undisputed that at least an imputed cost allocation or performance analysis is essential for cost optimization from a performance perspective. In practice, this can be impressively demonstrated with benchmarks.

Understanding cost allocation as an opportunity

The introduction of chargebacks or showbacks is often not driven by IT. Instead, IT is confronted with the decision by the CEO or CFO. This process is not very elegant, as cost allocation should be in the interests of the CIO. Budgets become transparent, services more comprehensible and strategic investments are driven by business support. IT’s passivity was previously triggered by the fact that, on the one hand, there were no tools for the automated and cause-based recording of IT expenses broken down by business services and, on the other hand, service portfolios were not defined in terms of services. ITFM tools solve this problem and link the competencies of IT with the requirements of controlling. However, the application owner and user of these tools is primarily IT. This should dispel the reservations of many CIOs on the subject of cost allocation. It is not a danger, but rather an opportunity.